In a dramatic turn, the United States debt ceiling bill recently received approval from the House, effectively sidestepping the contentious topic of crypto taxation.

Initially met with significant pushback from President Joe Biden and other quarters due to perceived benefits to wealthy tax evaders and cryptocurrency traders, the bill eventually secured sufficient backing. With the threat of a national default looming, passing this bill has become a major relief.

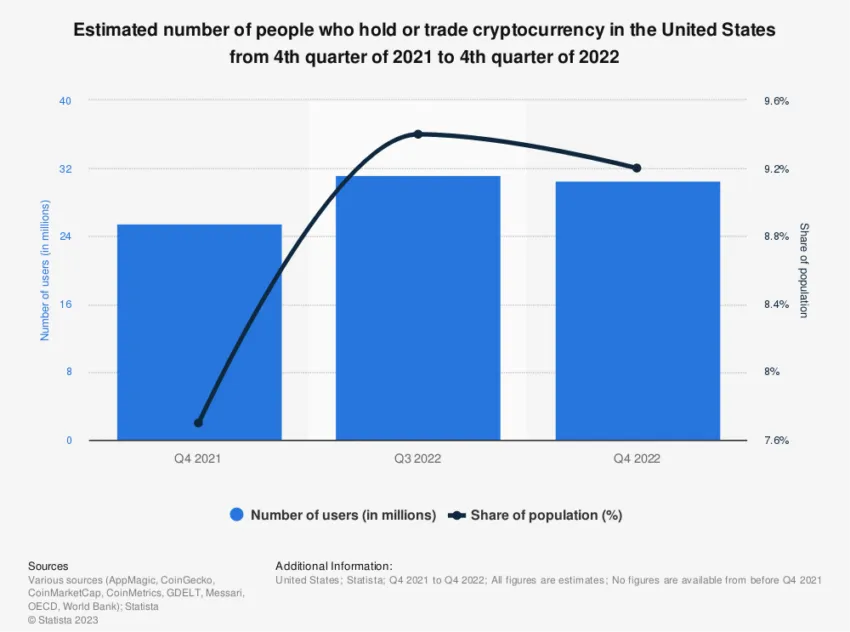

The Dispute Over Crypto

A critical point of conflict surrounding the debt ceiling bill was its implications for crypto traders. Specifically through the mechanism of tax-loss harvesting.

Widely employed by investors as a strategy to reduce their overall tax liability, this tactic was put under the microscope. It created significant discord among lawmakers.

“I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistance at risk for nearly a hundred — excuse me — nearly 1 million Americans,” said US President Joe Biden.

Nonetheless, the decision to withdraw the contentious issue of crypto taxation from the final bill led to a breakthrough. It enabled bipartisan agreement and passage of the legislation through the House.

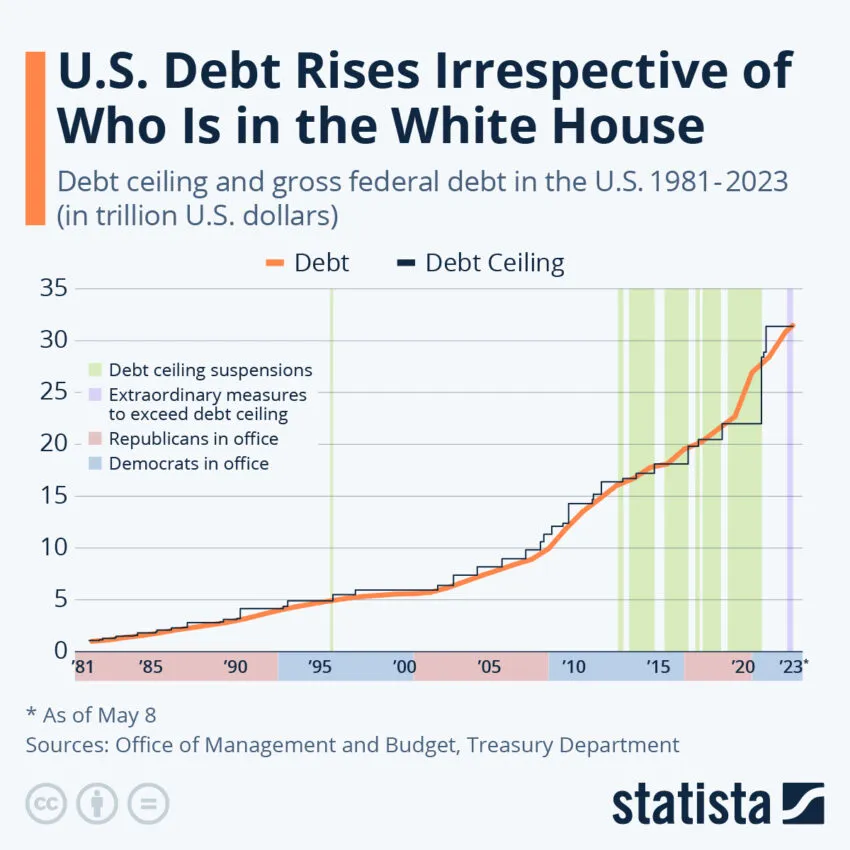

The Debt Ceiling: History and Implications

The debt ceiling has been a cornerstone of the US fiscal policy framework since 1917. It determines the upper limit on the total amount that the federal government can borrow to meet its financial obligations.

The impasse over the debt ceiling had stoked fears of a possible default by the US. However, with the bill’s successful passage, this crisis has been averted. It ensured the continuity of governmental operations and financial stability.

This debt ceiling bill is a landmark development in the US fiscal scenario concerning the distribution of the national budget. The bill encompasses numerous key issues, such as spending caps and redirecting unspent COVID relief funds.

Critics have voiced concern that the absence of new tax increases in the deal is a lost opportunity for raising revenue. At the same time, proponents argue it spares the citizens from additional financial burdens.

Debt Ceiling Bill: Inclusions and Exclusions

The new bill includes suspending the debt ceiling until the first quarter of 2025. It overrides the proposed spending cap set at fiscal year 2022 levels by Republicans.

However, the bill refrains from reverting spending to 2022 levels, maintaining non-defense spending at 2023 levels for 2024, with no budget caps beyond 2025.

“Tonight we all made history because this is the biggest cut in savings this Congress has ever voted for,” affirmed speaker of the US House of Representatives Kevin McCarthy.

Also included are comprehensive changes to the country’s energy-permitting laws. It intends to expedite the approval process for new projects, a cause championed by moderate Democrats.

This reform marks the first significant amendment to the National Environmental Policy Act since 1982.

Regarding education, the bill mandates an end to student loan payment suspensions. It requires loan holders to begin repayments after August, following over three years of suspension.

As part of the agreement, unspent COVID relief funds will be reclaimed, an initiative proposed by Republicans and accepted by the White House.

The bill also touches upon public welfare programs, raising the age limit for SNAP, a public assistance program formerly known as food stamps, and work requirements from 50 to 54 years. Simultaneously, it lifts these work requirements for veterans and those experiencing homelessness, irrespective of age.

A Significant Step Forward

While disagreements continue to color the political landscape, the passing of the US debt ceiling bill marks a substantial stride toward financial stability and responsible governance.

As the nation navigates the economic aftermath of the pandemic, this bill serves as a critical juncture, setting the course for the country’s economic future.

“This budget agreement is a bipartisan compromise. Neither side got everything it wanted,” affirmed President Biden.

The astute withdrawal of the contentious crypto taxation issue enabled the bill to garner the necessary approval, providing a blueprint for future financial stability and robust governance.

Despite the bill’s passage, several significant points of contention remained unresolved. While the agreement does not change the Inflation Reduction Act’s clean energy and climate provisions, it does not address the Republicans’ desire to repeal key climate-related provisions of the IRA either.

There are also no new tax increases in the deal, a point President Biden suggested, and Republicans had firmly rejected. The GOP’s demand for the rescinding of Biden’s student debt relief was also left unattended, with the bill leaving it untouched.

Still, President Biden concluded:

“This agreement is good news for the American people and the American economy. It protects key priorities and accomplishments from the past two years, including historic investments that are creating good jobs across the country.”

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

Be the first to comment