Solana-based liquidity staking derivative (LSD) coin Marinade ($MNDE) is up 160% in a continuing weekend pump as general interest in the LSD complex grows.

MNDE has risen from $0.03 at the end of Friday trading to $0.08 today, for a 166% gain.

Lybra Finance (LBR) sees dramatic retrace – time to buy?

Meanwhile Lybra Finance (LBR), which motored to an all time high above $0.05 last week, has also been garnering interest.

The Lybra protocol is an interest-bearing stablecoins that leverages stETH. Its price has retraced dramatically from its highs and it is currently trading at $0.01045.

Marinade protocol, which has been around since 2021, has seen its TVL collapse from a high of $1.87 billion in November 2021 to just $119 million today.

In contrast Lybra has come from nowhere to see its TVL top out at $200 million, and currently stands at $188 million.

$LBR is a persistent trender on Dextools over the past couple of weeks. Both coins are part of a wider DeFi 2.0, Next Gen DeFi trend, with its innovative impetus coming from stETH.

The Ethereum Shanghai upgrade on April 12 allowed stakers to claim their rewards for the first time. Although staking has been on a steady climb, since the upgrade the trajectory of ascent has become steeper, as the Glassnode chart below shows:

ETH 2.0 TVL pumps to $24 billion

ETH2.0 TVL is now $24 billion, with another acceleration in the inflows starting on May 30th and showing no sign of slowing.

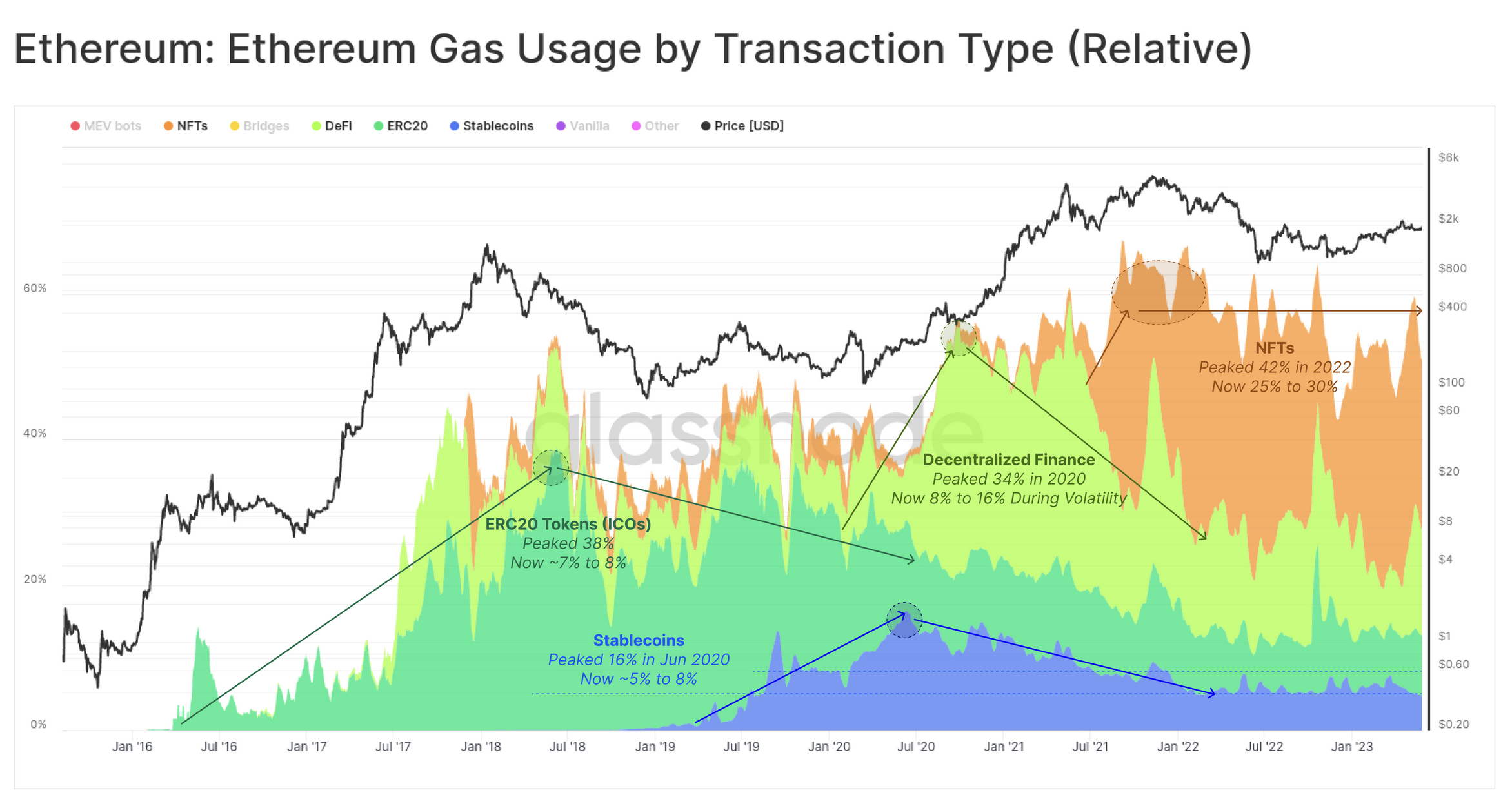

Although the proportion of gas fees devoted to DeFi activities has tailed off since the end of 2020, there are tentative signs that could be changing, as the Glassnode chart below shows:

These are the top players in stETH (includes Lido, Rocket, Frax, Coinbase, Ankr, Binance), as listed by DeFiLlama:

Three other players in the space that are catching the eye are DerivaDEX, Linear Finance and Injective.

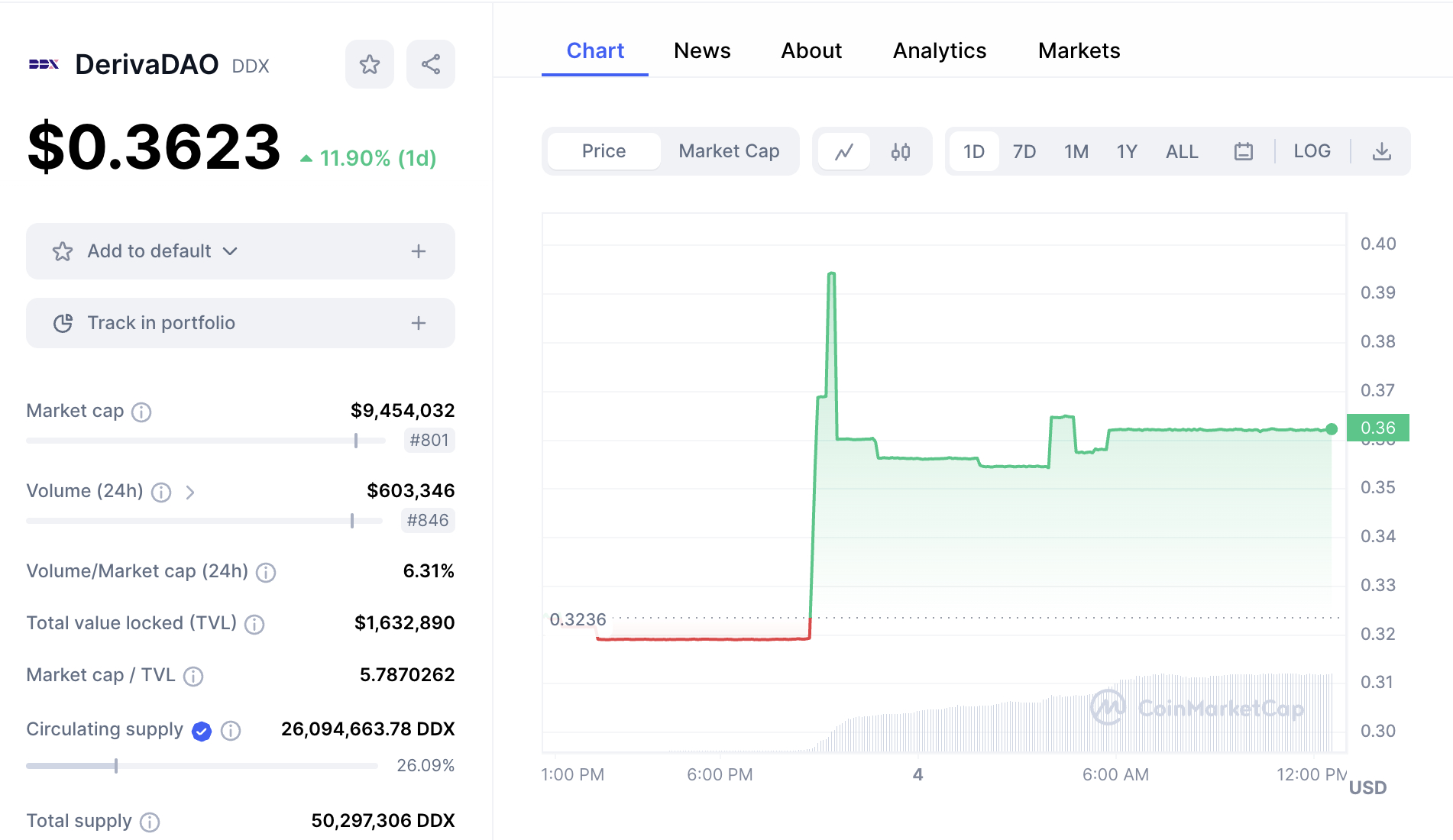

DDX price advances 11% in 24 hours

$DDX – DerivaDEX – which began life in 2020 is, as its name suggests, a decentralized derivatives exchange. It is backed by some big venture capital names, including Polychain Capital, Dragonfly Capital, Electric Capital and Coinbase.

DDX is up 11% today at $0.3623.

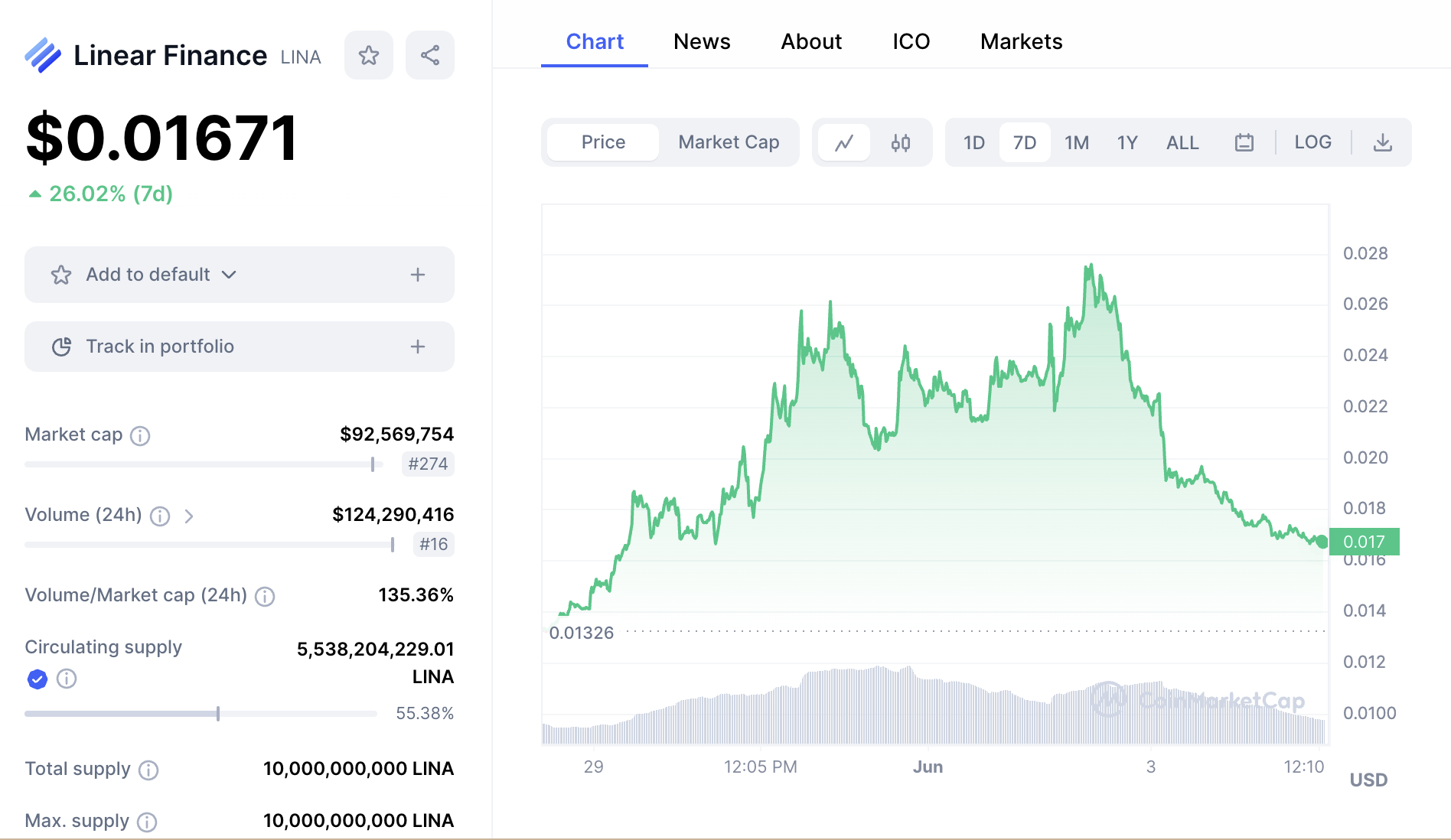

LINA price up 26% in 7 days

Linear.Finance (inception 2020 – $LINA) focuses on trading liquidity staking tokens (LSTs) with its LUSD token, which is minted by staking LINA.

The $LINA price is up 26% at $0.01671 in the past 7 days, although trading lower today.

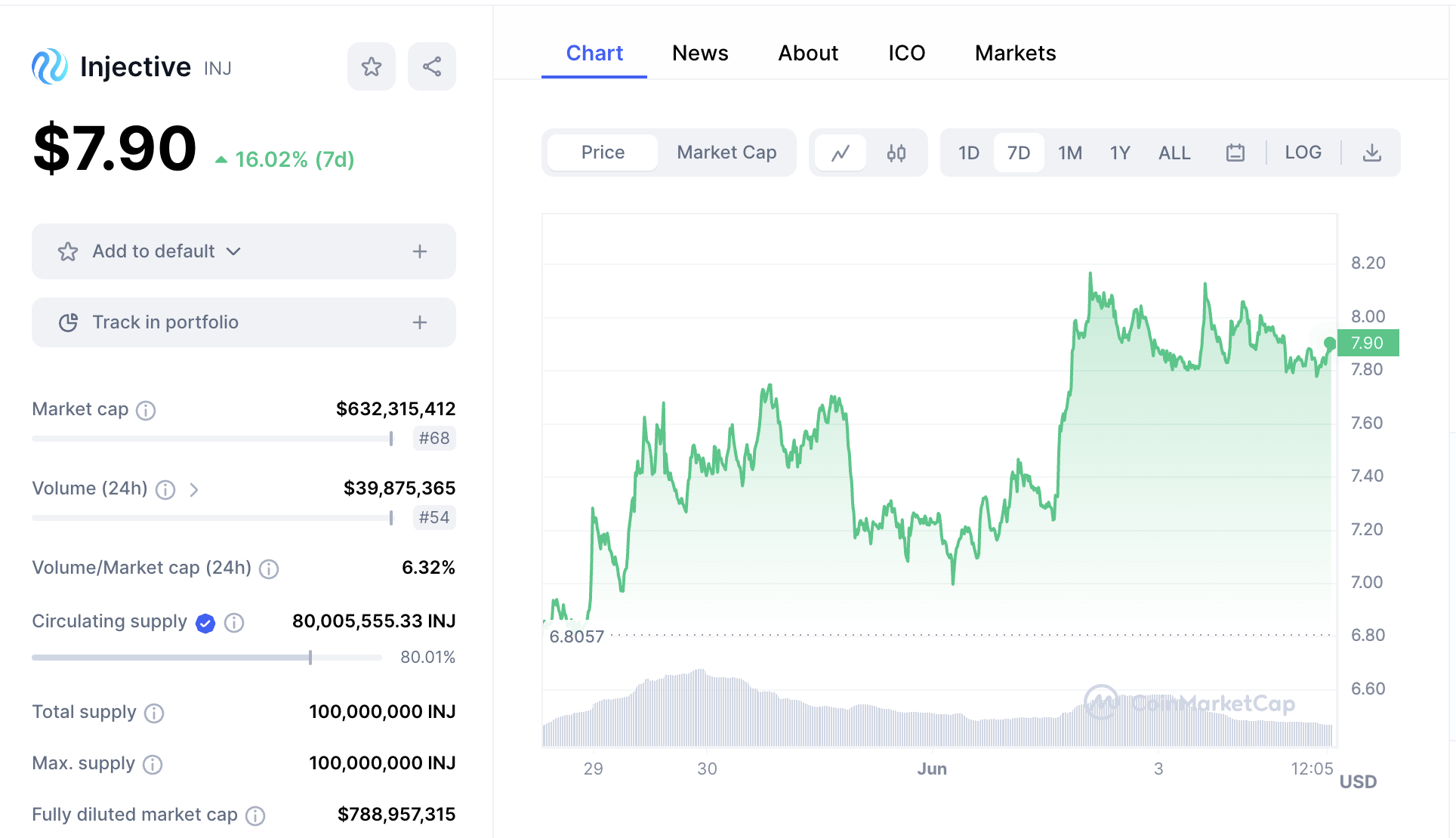

INJ price up 17% in past 7 days

Injective ($INJ) is an all-encompassing DeFi-focused Layer 1 blockchain (Cosmos), that includes dApp platform, DEX and Lending protocol. Its recent Avalon Mainnet upgrade went smoothly and brings, among other things, even faster block speeds to the network.

Injective includes Jump, Pantera, Binance and Mark Cuban among its backers.

INJ price is 17% higher in past 7 days at $7.90.

Alternative ways to gain exposure to LSD

A wide array of token can plug into the LSD scene if they have tokens which generate a yield from staking.

Wall Street Memes ($WSM) could be one such token. Currently in presale it has the backing of an existing community of 1 million followers across Instagram and Twitter and has its roots in the meme stocks movement.

As a community-first coin, which is in presale now and devote 100% of token supply to the community, it promises to pay rewards to its community. This could tale the form of staking, in which case liquid staking derivatives could be created off the back of the token.

The token has raised in excess of $3.7 million from eager investors in barely a week and could see 100x returns for its early buyers.

Visit Wall Street Memes website

Other coins that could benefit from the DeFi 2.0 innovations are Ecoterra, the recycle to earn app and yPredict, an AI powered trading platform that offers passive income.

Be the first to comment