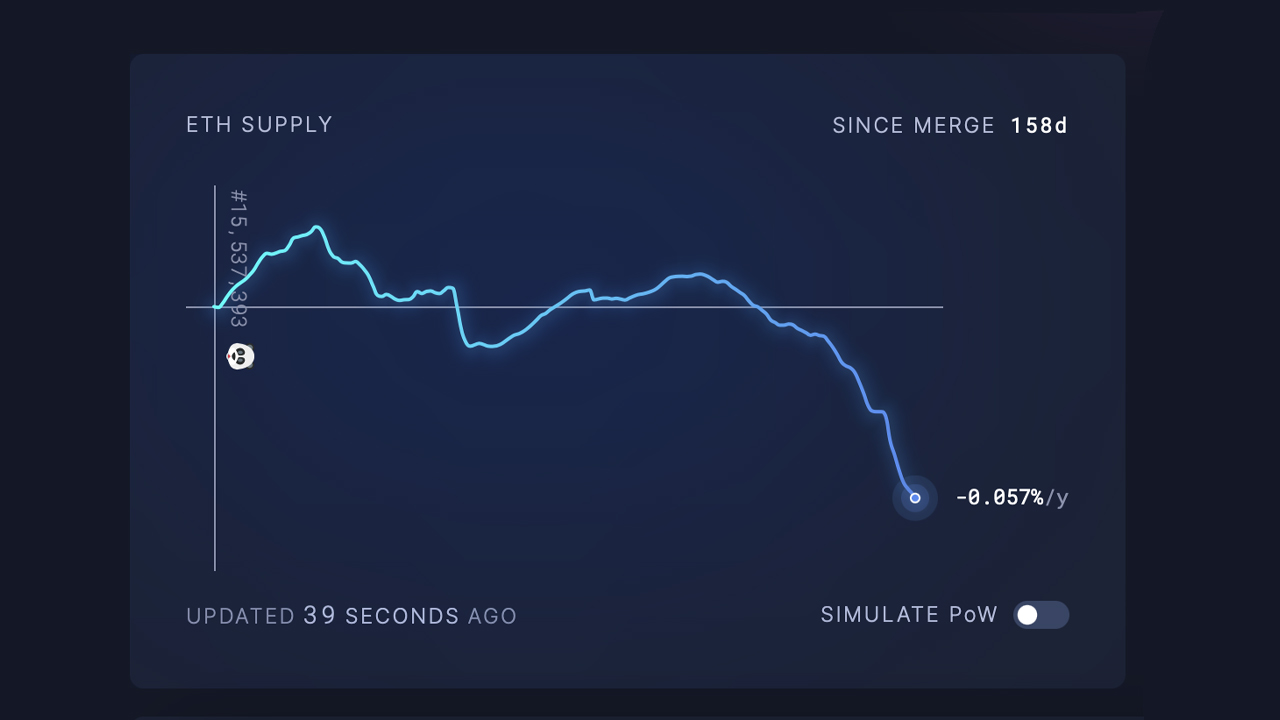

After the transition from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum’s annual issuance rate has been reduced to negative 0.057%, according to statistics 158 days after The Merge. The metrics indicate that more ethereum tokens have been removed than issued, and if the chain were still under PoW consensus, 1,823,678 ether would have been minted to date.

Ethereum’s Negative Annual Issuance and Unlocked Ether in March Could Shift Equilibrium

Statistics from the analytics website ultrasound.money show that the Ethereum network is deflationary these days. More than 1.023 million ether is removed from circulation annually, according to metrics following the London hard fork’s implementation of EIP-1559. Since the transition from proof-of-work (PoW) to proof-of-stake (PoS) known as The Merge, the current annual issuance rate is negative 0.057% or -29,797 ether.

The data shows that more ethereum (ETH) is currently being removed from circulation than is being issued. If Ethereum were still using PoW, the issuance rate would increase by about 3.49% annually. As of 10:30 a.m. (ET) on Feb. 20, 2023, data indicates that 1,823,678 ethereum tokens would have been added to the number of coins in circulation under PoW consensus. As of 10:55 a.m. (ET) on the same day, approximately 120,491,331 ethereum (ETH) tokens are in circulation.

At that same time, 16,763,815 ether is locked into the Beacon chain contract, and when the Shanghai update occurs in March, many of those coins could be released from their locked state. The locked ether represents $28.61 billion of the second-largest cryptocurrency’s $205.77 billion market valuation, or 13.91% of the circulating supply and market value. According to statistics from ultrasound.money, Ethereum’s current annual issuance rewards are 4.1%, and the burn rate for non-stakers is 1.8% per year.

What do you think the future holds for Ethereum’s issuance rate and circulating supply as the network continues to transition to proof-of-stake and implement updates like the upcoming Shanghai update? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photo credit: ultrasound.money

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Be the first to comment