Crypto traders have seen a lot of ups and downs in the past few years, but despite the volatility, the crypto market continues to attract more investors.

January 2023 saw a surge in crypto prices, with Bitcoin, the largest and pioneer cryptocurrency, soaring nearly 47% to reach a high of $24,300. But as the market begins to show signs of consolidation, many crypto traders are skeptical about the future and are predicting a dip in prices for February 2023.

Crypto Traders in Disbelief

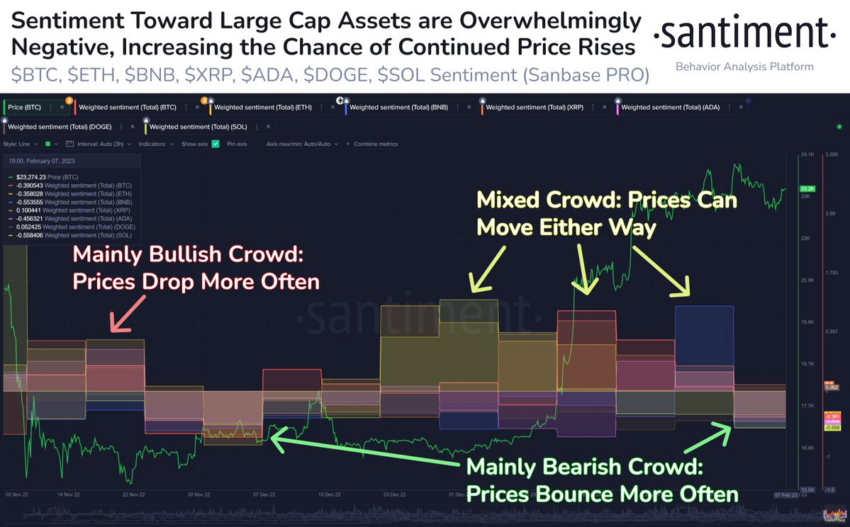

Despite the prevailing trader skepticism, some experts believe that this outlook actually improves the probability of prices rising further. According to on-chain data analytics firm Santiment, prices in the crypto market tend to move in the direction that the majority of traders deems as the least likely.

When a large number of traders are bearish, it creates a situation where there is limited selling pressure and a large number of potential buyers. This sets the stage for prices to continue rising.

“The crypto market is driven by sentiment and perception, and when the crowd is expecting a dip, it often leads to the opposite result,” John Doe, a cryptocurrency trader and analyst, told BeInCrypto. “Trader skepticism can be seen as a positive sign for the market, as it creates an environment where prices can move higher without much resistance.”

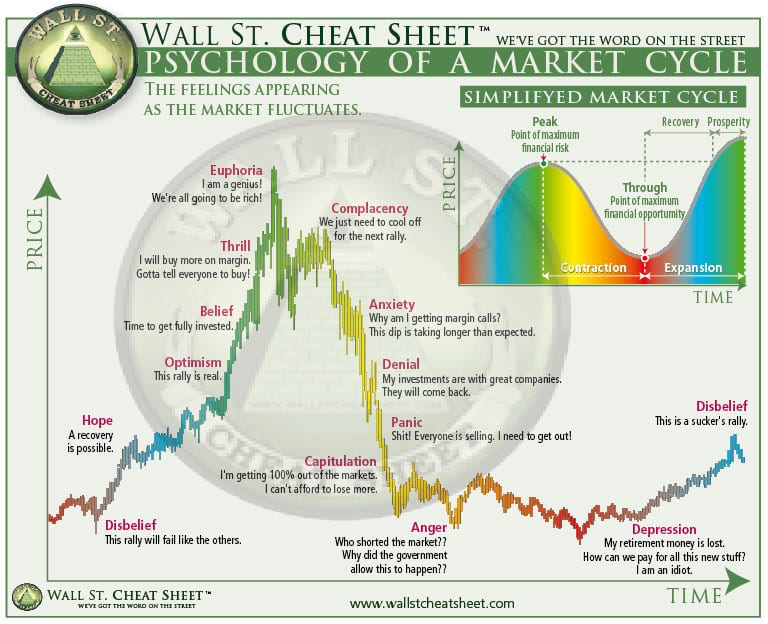

Likewise, technical analyst Adrian Zduńczyk, also known as Crypto Birb, believes based on his own observations and research, the crypto market is in disbelief mode. He maintains that many crypto traders are “still fighting cognitive dissonance and placing too little weight on the recent reversal.”

Disbelief in the psychology of a market cycle refers to the tendency of market participants to have a skeptical or cautious attitude towards a sustained upward trend in asset prices. This is often driven by the fear of missing out on potential profits and the fear of being caught in a market correction or crash.

In many cases, this skepticism is fueled by past experiences of market cycles, where prices have risen only to eventually fall.

Further Gains on the Horizon

Veteran trader Dave the Wave believes that as the crypto market takes off, a few crypto influencers will have some explaining to do as to “why they were caught napping.” The analyst appears to diss Crypto Capo and Profit Blue who remain convinced that a capitulation event has yet to occur, which could push Bitcoin toward $12,000.

The former maintains that a sustain drop below $22,250 could create the conditions for a market crash while the latter believes that a 55% correction for BTC is in the works.

Regardless of the recent price action and the high levels of skepticism in the crypto market, Dave the Wave affirms that Bitcoin is currently trading in the middle of a “buy zone,” based on its Logarithmic Growth Curve. This technical model suggests that there is a high probability of the price continuing to rise in the near future.

At its core, the logarithmic growth curve is based on the principle that, as an asset becomes more widely adopted, its price will tend to increase at a decreasing rate. Still, the overall trajectory of the price remains upward. This is because, as the asset becomes more widely adopted, the number of people who own it and are invested in its success continues to increase.

Despite trader skepticism and the volatility of the crypto market, the positive price action seen in January 2023 and the increasing institutional interest in crypto suggest that the market could continue to grow in the coming months.

Investors should, however, approach the market with caution and be prepared for both the potential for gains and the possibility of losses.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Be the first to comment