A report by Kaiko shows that 72% of ethereum liquidity is concentrated in five crypto exchanges. ETH balances also hit a 5-year low recently.

Reports show that 72% of ethereum liquidity is concentrated in five major crypto exchanges. Digital assets data provider Kaiko published a report on May 29 that showed this figure of ETH liquidity is limited to Binance, Bitfinex, OKX, Coinbase, and Kraken.

FTX Collapse a Prime Reason for Consolidated Ethereum Liquidity

As some of the biggest crypto exchanges in the world, it’s unsurprising that the concentration would be high, but analysts are raising eyebrows at the fact that it is to this extent. Other exchange’s reserve wallets—which come to 41 in total—account for only 28% of ETH’s liquidity.

Kaiko states that the liquidity has moved to these exchanges as a result of the FTX collapse. It emphasized that “since the collapse of FTX last year, there has been little good news on the liquidity front for crypto assets.”

Kaiko also explained that liquidity is moving away from the United States. The share of market depth in the country is about 40%, which is down from a peak of 54% in May 2022. The data provider believes there may be continued liquidity consolidation in a few exchanges for all assets and not just ETH.

Stablecoins Showing Resilience Amid US Debt Ceiling Drama

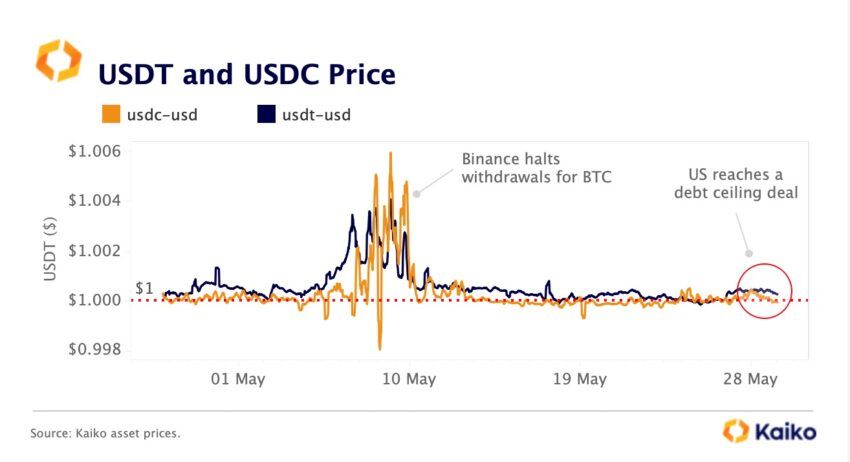

Kaiko also briefly went over the state of stablecoins in the crypto market. It noted that the two largest stablecoins, USDT and USDC, closed the week trading at a slight premium.

Of particular note is the fact that there was little volatility with respect to these stablecoins. However, there was one occasion where stablecoins swung in price when Binance halted BTC withdrawals in May.

Kaiko states that the discussions about the U.S. debt ceiling negotiations, which are nearing resolution, have not affected stablecoin prices. It suggests that stablecoins have reached a state of safety.

Ethereum Balance on Exchanges Reaches 5-Year Low

Meanwhile, balances of ether on exchanges have hit a five-year low, which usually suggests that investors have confidence in the asset’s growth. There is about 17.882 million ETH on centralized exchanges, which amounts to 14% of the total supply.

At the same time, staked ETH deposits also have hit a new all-time high. Ethereum’s Shapella upgrade allowed the unstaking of ETH and helped boost adoption and prices. The cryptocurrency is currently trading at around $1,900.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

Be the first to comment